March 01, 2023

Infrastructure Investing: Embracing Complexity in Times of Structural Change

After a tumultuous 2022, the US economic outlook for 2023 remains cloudy. Renewed uncertainty about inflation and the Fed means markets will continue to be volatile. With that in mind, we believe that infrastructure can offer key attributes—downside protection, low correlation to markets, potential protection against inflation—for investors deploying capital today.

We believe that a nuanced infrastructure investment strategy with a disciplined, price-conscious investing mindset—purchase price matters—is more crucial than ever. We see the middle-market as the most fertile ground for opportunity, especially at a time when the large capitalization space is awash in capital.

Tags

Sports are no longer just culture or entertainment; they are a scalable, investable asset class. Financing this business is becoming one of today’s most compelling growth stories—and where the next records are poised to be broken.

Sitting between private debt and equity, hybrid investments are increasingly in demand as companies continue to face higher borrowing costs, limited access to traditional debt and volatile capital markets. This article, authored by Jason Scheir, Head of Hybrid Value at Apollo, showcases this strategy through three real-world examples.

Real Assets | Apollo in the Media

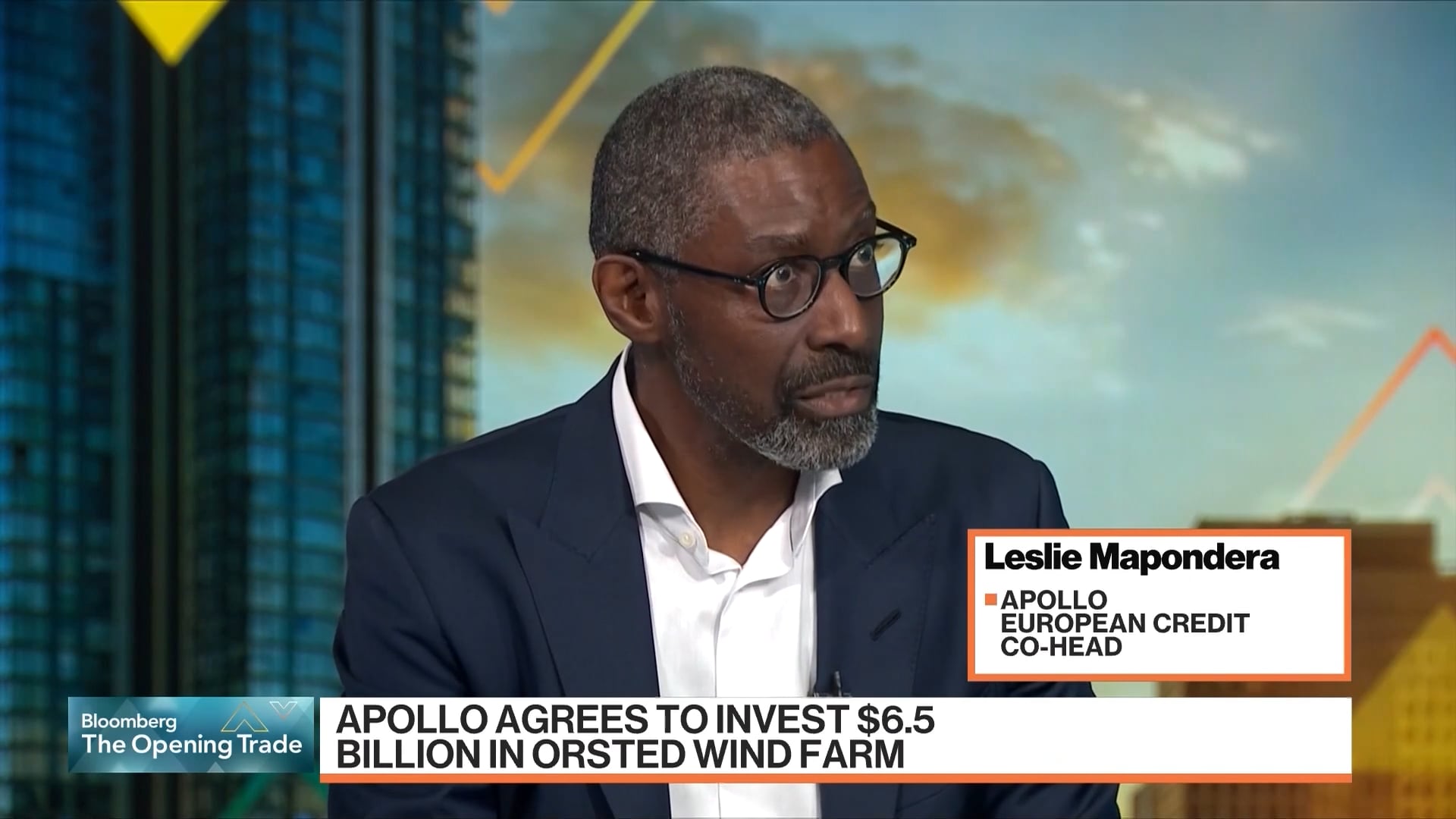

Leslie Mapondera Discusses Apollo’s $6.5 Billion Commitment to Ørsted’s Hornsea 3 and More on Bloomberg

On Bloomberg, Apollo Partner Leslie Mapondera discusses Apollo’s investment activity across European energy and infrastructure, including the firm’s recent $6.5 billion commitment to Ørsted’s Hornsea 3, the world’s largest offshore wind project.