- The Apollo Approach

- Solutions

- Insights & Education

- Contact Us

- The Apollo Approach

- Solutions

- Insights & Education

- Contact Us

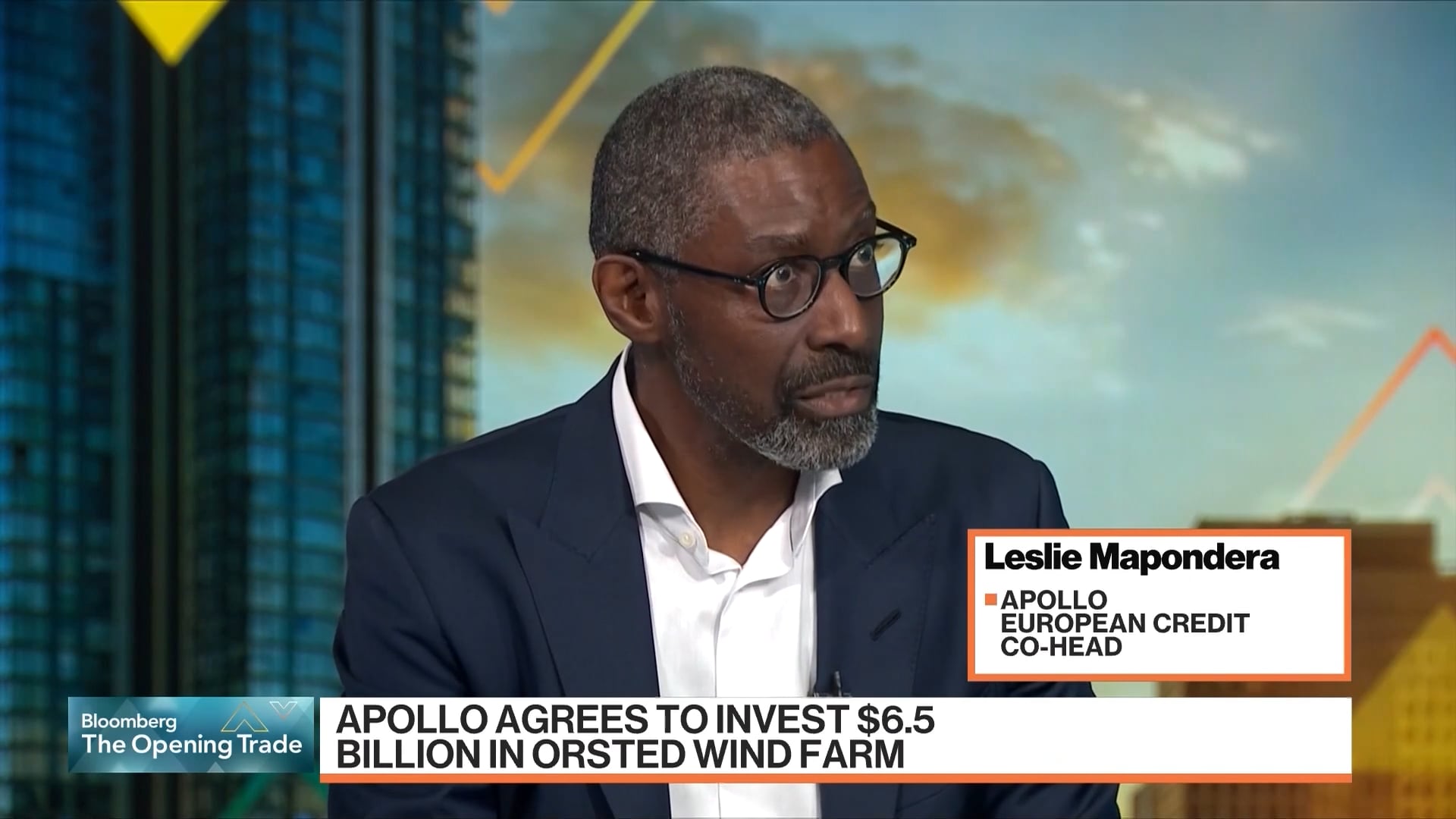

The Apollo Approach

Anchored in our “purchase price matters” investment philosophy, we seek to generate excess returns per unit of risk across our Real Assets ecosystem. Leveraging the expertise of Apollo’s integrated investment platform, we seek attractive opportunities globally and across the real-asset spectrum—including real estate, infrastructure and clean-transition investing—to drive risk-adjusted performance throughout market cycles.

What Makes Us Different

Our Strategies

Global, integrated business with a strong network and experience seeking to generate spread, investing across the risk spectrum and asset classes. Apollo’s Real Estate franchise takes a value-driven, solutions-oriented approach and provides investors with multiple pathways to bespoke investment exposure.

Fully integrated, fast-growing business focused on opportunities in the mid-market in North America and Europe. Our disciplined approach to infrastructure investing focuses on control-oriented acquisitions, corporate carve-outs, and opportunistic and structured solutions that tap into our deep capital markets experience. Many of our infrastructure investments are focused on renewable energy.

Apollo’s Sustainable Investing Platform leverages the firm’s deep experience across asset classes to deploy capital in key sectors driving today’s energy transition. We aim to deploy $50 billion in clean energy and climate capital by 2027 and see the opportunity to deploy more than $100 billion by 2030. Apollo looks to serve as a leading capital partner to companies and communities globally.

Insights

Apollo Academy: Learn from Experience

Learn more about how to deploy and capitalize on alternatives opportunities with a complete ecosystem of educational videos, classes, and live events—all eligible for CE credits—as well as whitepapers, articles, podcasts and much more.

Explore More Alternative Investment Solutions

Interested in Learning More?

Contact Us

To get in touch with one of our team members, please provide us with the following information.

If you already have a relationship with Apollo, please reach out to your Relationship Manager. If you are an Investor, please connect with your Financial Advisor.