Credit | Case Study

Hertz: Apollo’s Flexible Capital at Work

Amid bankruptcy at the height of COVID, Hertz found in Apollo a financing partner capable of executing a quick-turn, multi-billion-dollar series of transactions that enabled the company to continue operations and meet customers’ needs.

Extensive industry expertise coupled with a deep knowledge of Hertz positioned Apollo to provide the company with a series of bespoke capital solutions during a compressed timeframe. Learn how Apollo’s nimble, collaborative financing approach amidst this complex situation demonstrated how Apollo is financing stronger businesses.

Tags

Credit | Investment Insight

Credit Opportunities in 2026: From a Seller’s Market to a Buyer’s Market

John Cortese, Partner, Co-Head of Corporate Credit, explains how AI capex and M&A resurgence are shaping credit's most dynamic opportunity set in years.

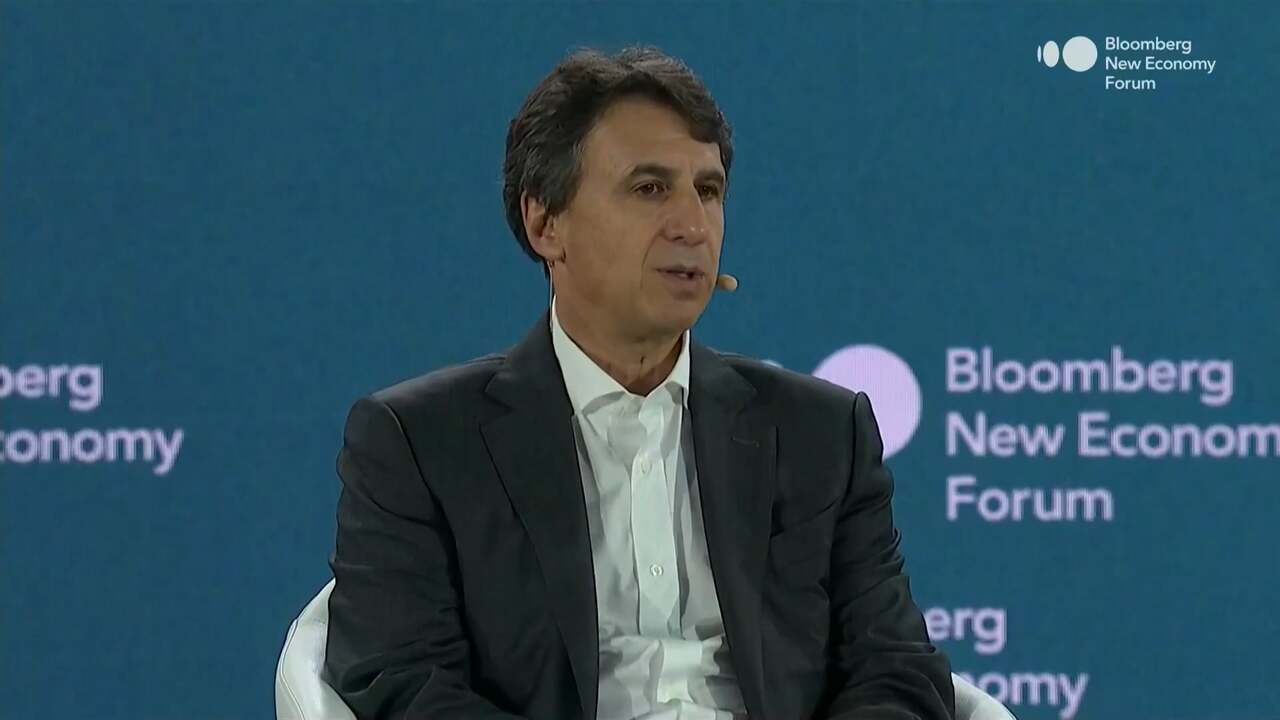

At the Bloomberg New Economy Forum, Marc Rowan joined Ravi Menon for a candid conversation on how global finance is adapting to meet the changing needs of economies. They examined the rise of private markets as engines of long-term investment, the reshaping of public markets, and the mix of capital needed to support the cap-ex needs of critical infrastructure and the energy transition.

Financial Services | Apollo in the Media

Jim Zelter Discusses Credit Markets, AI Infrastructure and Economic Resilience on Bloomberg TV

Apollo President Jim Zelter joins Bloomberg TV to discuss expectations for 2026, the evolving AI-driven CapEx cycle, shifts within investment-grade credit markets and why dispersion is creating attractive opportunities for credit investors.